Discover the compelling reasons why Green Investments contributes to a sustainable future and promises substantial financial returns. Join the green revolution and make your investments count for the environment and your pocket.

Table of Contents

Introduction

An avalanche of alarming geo-political events and the surge in unfavorable climate events have undoubtedly proven that the call for cleaner energy projects echoes louder than ever. With the switch to clean energy, there is a critical need for increased global funding for renewable infrastructure (green investments ), especially in emerging and developing economies. This has been kickstarted in India by initiatives from the Indian Prime Minister Narendra Modi’s commitment to achieve net-zero emissions by 2070, highlighting a growing global awareness and commitment to accelerating the energy transition. Moreover, a British company, Shell, has invested about $2bn (£1.4bn) since 2016 on renewable energy.

However, reaching India’s net-zero emissions target demands a staggering $10 trillion investment, giving rise to challenges for investors :

- In sourcing and investing in clean energy assets due to information gaps and focusing on short-term goals.

- Investor involvement is hampered by the scarcity of precise and dependable data regarding returns on unlisted assets.

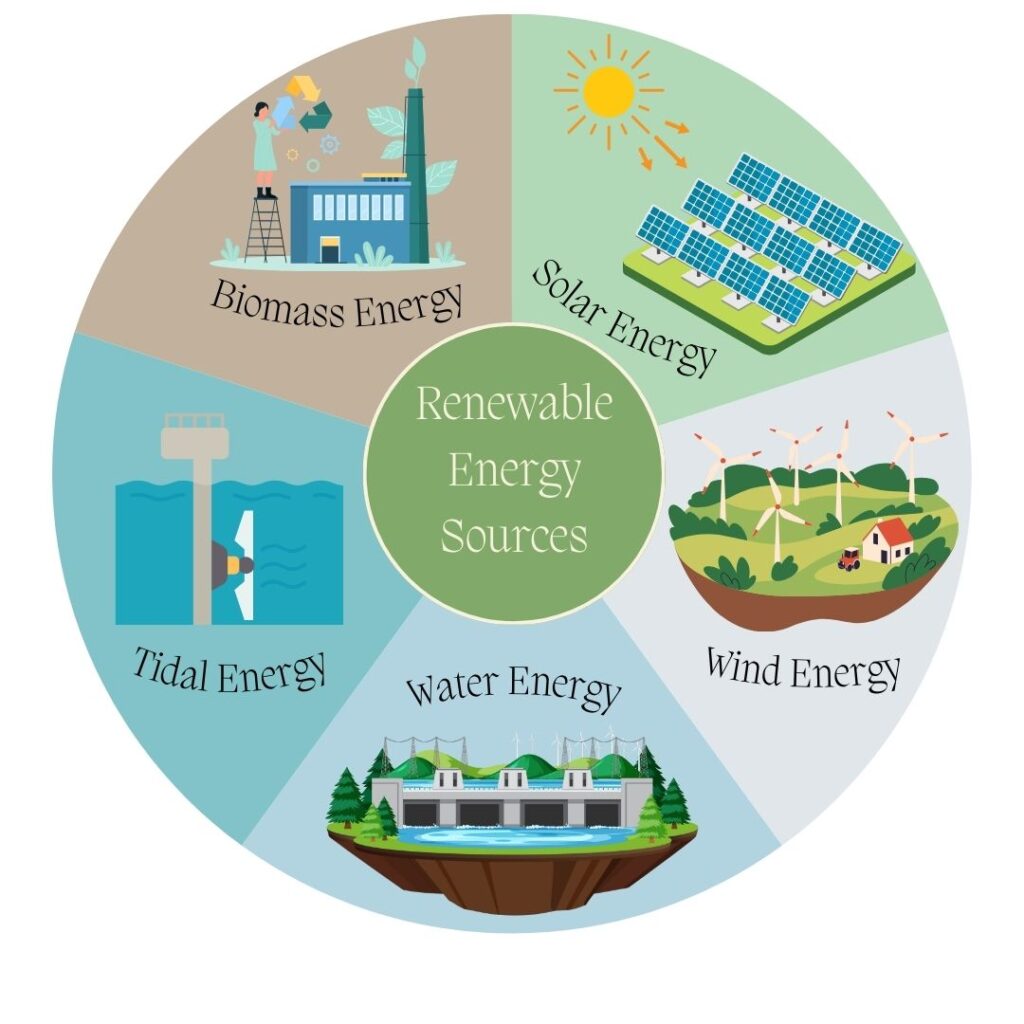

Types of renewable energy

Before diving into the why and how of investing in renewable energy projects, let’s explore the diverse world of renewable energy :

- Solar energy: The Sun’s energy is captured by solar panels on homes or in vast farms.

- Wind energy: Wind turbines, onshore and offshore, supply a quarter of the UK’s electricity.

- Water energy: Energy produced by flowing water, known as hydropower.

- Biomass Energy: Recycling organic materials, such as wood, crop residues, or waste, into energy through combustion or biofuel production.

- Tidal Energy: Utilizing the energy generated by the ebb and flow of tides to generate electricity with underwater turbines.

Decision making factors for green investments

Investors investing in renewable businesses are advised to approach the decision-making process with strategic acumen and a thorough understanding of the factors influencing this sector.

The global economic landscape primarily plays a pivotal role in shaping investment outcomes. A strong economy boosts the need for more electricity, concurrently elevating the market value of companies engaged in power generation. This highlights the importance of aligning investment decisions with the prevailing strength or weakness of the global economy.

Secondly, Green companies are also affected by regulations and policies in different companies worldwide. Governments may demand a certain amount of energy to be renewable or penalize companies that use fossil fuels, thus benefiting green businesses. In contrast, they may also withdraw green incentives, pushing prices down, which the investor needs to be aware of.

Lastly, While the green energy sector presents substantial growth potential, companies with compromised financial stability may encounter challenges even within this burgeoning market.

Why invest in renewable energy?

Some of the strongest reasons to invest in renewable energy business are :

1. Profitability potential expands with rising demand.

According to GreenPrint’s findings, 66% of Americans pay extra for sustainable products, while 78% prefer environmentally friendly options. Thus, the surge in demand for eco-friendly products and services isn’t just a green trend; it’s a profit boost for clean energy businesses!

2. Renewable Energy Helps Companies Meet Environmental, Social, Governance (ESG) Targets

Using renewable, clean energy means fewer harmful emissions (such as carbon dioxide) are released from the process over the source’s lifetime. Impacting the volume of emissions a business produces significantly decreases the carbon footprint.

ESG reporting encompasses various frameworks and approaches, but measuring harmful substances and emissions is standard, and companies in every industry often aim for specific targets. Renewable energy could grow the economy by creating jobs in rural areas and diminishing fuel imports, which meets the ESG requirements.

3. The Use of Renewable Energy Appeals to Consumers and Investors

In 2021, 37% in the US strongly favored renewable energy. Globally, there’s a rising concern about its impact on attitudes towards companies. Investors looking to add to their ESG investing profiles will look for companies that fit their vision and values, and renewable energy is an appealing option.

4. The Costs of Renewable Energy are More Stable

Global events can disrupt traditional fuel supplies, leading to dramatic price escalations. In contrast, generating renewable energy incurs lower operating costs, resulting in more stable energy prices. Research suggests that, across various applications, renewable energy is often more cost-effective, with the potential for further cost reductions as adoption accelerates.

5. Renewable Energy is Good for the Environment

Beyond finances, embracing renewable energy is an ethical opportunity to invest in line with your values. While the transition demands effort, it’s a lasting global shift. Business leaders must weigh the cost against future market trends, consumer expectations, and the flexibility of making changes voluntarily rather than when legally obligated. It’s not just a choice; it’s a commitment to a greener future.

Conclusion

Investing money in renewable power can be one of the considerable ways to save our planet from the ravages of climate change. But we often need to remember that where we invest our money can make a difference. The reasons to invest are clear: rising demand, alignment with ESG goals, consumer and investor appeal, cost stability, and positive environmental impact.

As we navigate a world where economic, regulatory, and financial factors converge, green investment emerges as a wise financial decision and a conscious commitment to fostering a greener, more sustainable planet. However, The absence of reliable data, a lack of transparency in the unlisted sector, limited flexibility, credit risk, regulatory hurdles, and currency issues all represent obstacles to investment.

References :

- https://inspirage.com/2022/04/how-renewable-energy-can-revitalize-your-business/

- https://www.weforum.org/agenda/2022/09/energy-crisis-investment-renewable-energy-developing-economies/

- https://future-business.org/why-are-companies-investing-in-renewable-energy/2/

- https://www.thetimes.co.uk/money-mentor/investing/diy-investing/renewable-energy-how-where-invest